Med Tech Talks

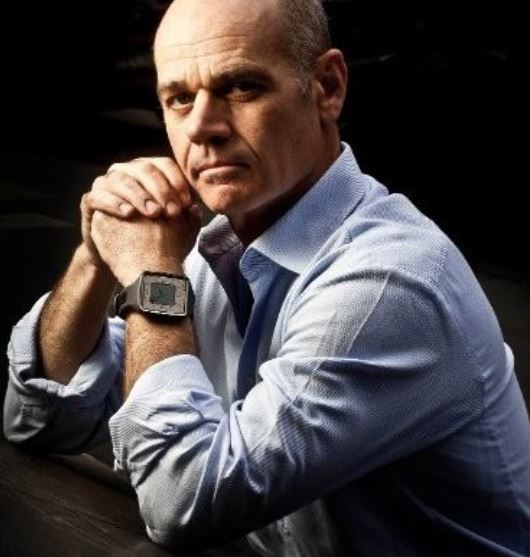

Insights into innovation investment from venture capitalist Dr Chris Smith

Dr Chris Smith, Partner at Brandon Capital

Chris has extensive experience in the global biotech industry. With a PhD in immunology and an MBA specialising in innovation and entrepreneurship from the University of Cambridge; he has also previously been a business development manager with CSL; and is currently a Director of Aravax, Denteric, Ena Respiratory, MycRx, Q-Sera and Axelia Oncology, just to name a few.

In this episode you will hear about:

More information:

Learn more about Dr Chris Smith

Dr Chris Smith [00:01:19] Oh, it’s great to be here. Thanks very much, Robert.

Robert Klupacs [00:01:21] I’m exhausted just reading that CV to start with.

Dr Chris Smith [00:01:24] Yeah.

Robert Klupacs [00:01:25] Pretty impressive.

Dr Chris Smith [00:01:26] Thank you.

Robert Klupacs [00:01:27] Let’s start. Chris, you’ve had a fantastic career to-date. And for our listeners, you can’t see him, he’s still pretty young – with a long way to go – but are you able to share with our listeners the journey so far that’s led you from your PhD postdoc to science at University of Cambridge, CSL, and now a partner in Australasia’s leading venture capital firm.

Dr Chris Smith [00:01:49] Yeah, for sure, for sure. And you’re right. When you talk about the career to date, you make me sound like, I’m older than I feel like I am, but I’ve got to recognise that I am getting a bit older now.

Robert Klupacs [00:02:00] Mature.

Dr Chris Smith [00:02:00] Mature. Is that what it is. Thank you. It’s been great. It’s been a great career. I’d like to say it was designed and I thought about it and had it all planned out, but that just wasn’t the reality of how things go. You know, it’s so much has been fortuitous, opportunities that have come up at the time. A lot of people, you know, very few people will know that I dropped out of university in the first, you know, six months because I wanted to pursue a career in horse riding. Well, and I went and did that for, a couple of years overseas and those sorts of things until I was ready to come back and do, do my, science degree and my studies more seriously. And it was, it was probably the best thing I ever did, to be honest with you. I started at Melbourne University, not far from not far from here at all. I had a great a great undergraduate degree. I chose subjects, you know, sometimes at random. And I think choosing immunology at the time was, you know, I like to do because it was hard, you know, it was really difficult. And it’s one of those subjects, that there was so, so little known at the time. It was the late 90s. And, people were trying to understand; we had vaccines, we certainly understood vaccines, but there was a big push in research to try and understand immunology better. But we certainly weren’t in the heyday that we’re in now.

Robert Klupacs [00:03:16] Yeah.

Dr Chris Smith [00:03:17] And like that’s fortuitous. You know, we didn’t know. I didn’t know at that time that immunology was going to be the driver of oncology drugs. And, you know, essentially the biotech industry for the next, you know, 20 years.

Robert Klupacs [00:03:28] Did you know what a checkpoint inhibitor was back then?

Dr Chris Smith [00:03:30] That wording had not been invented yet. Right? That certainly wasn’t that certainly wasn’t the thing. Not even close. And so, my PhD at, at the Walton and Eliza Hall Institute actually took me into checkpoint inhibitors and those sorts of things, even though we didn’t talk about them that way. And again, just fortuitous luck that that was that was my PhD topic. And, you know, T-cells and those sorts of things. So it was wonderful. And after an amazing, privileged PhD I, I moved across to the University of Cambridge and went into virology, which, you know, turns out with a couple of pandemics later and Covid is a really useful background skill to have as well, to be honest with you.

Robert Klupacs [00:03:12] Yeah.

Dr Chris Smith [00:03:13] Again, unplanned, but, you know, fantastic opportunity as well. I always knew I wanted to do business and science, but neither of my parents come from that background, so I didn’t know what that meant. And so it was a more conceptual, I have a, you know, quite an entrepreneurial family. And so I like the idea of building businesses and those sorts of things. And so I did an MBA at Cambridge while I was there, and that wasn’t luck. That was a choice I made at the time. It’s one of the few choices I’ve made where I’ve really gone, ‘I’m going to do this for my career’. And so rather than buying a house sitting in Australia’s real estate market or in the old Cambridge real estate market when they were low, I chose to invest in myself instead. Now, looking back, whether that was a good financial decision, we’ll still have to wait and see. But, but it was, you know, it certainly opened up doors for me. And then coming into CSL and learning the skills that I learnt there at such an amazing company, and to be part of that’s been great. And now I’ve been at Brandon for 12 years and and grown and learnt the VC business while I’ve been there.

Robert Klupacs [00:05:12] Just tell me just what was the what was the link between leaving CSL and going to Brandon? How did that come about?

Dr Chris Smith [00:05:19] It came about through networks and through knowing people and me knowing the managing director there, Chris Knave, well, and just from being in the sector, but it’s about I think, at the time, it was an honest conversation with myself around where I’d be a good fit. And, you know, I’m entrepreneurial. You know, I like doing things that are, you know, high risk. And I like, you know, trying to see where things can go in in a smaller, you know, in environments where there’s lots of responsibility and lots of decision making, like in a, in a venture capital firm. That was a really good fit for me. And I just immediately felt like the right fit. So I made that. That’s that’s a big jump, right? You know, it’s a big call to leave a company like CSL. And that was at the time. And I had many, many people tell me that I’d made the wrong choice. And, maybe I did and I’ll never know. But that’s a nice thing about life. You can’t, you don’t get to do it again.

Robert Klupacs [00:06:14] Well, you’re smiling. So, happy.

Dr Chris Smith [00:06:15] Yeah. Yeah, yeah, yeah.

Robert Klupacs [00:06:16] Clearly, you know, as we’d gone through before, you got very technical qualifications. But for our listeners, can you tell us what you think is the most important aspect for you in your current role, you know, of assessing and backing technologies? Is it your technical skills? Is it your business skills or is it your nose – your gut feel for what’s going to work?

Dr Chris Smith [00:06:37] I think yes, it’s probably all of those all of those things. I think we at Brandon Capital generally invest, very early, okay. Which means that the opportunities, can often be even before there’s filed intellectual property. Okay. They’re very, very technical. I still in my job, every single day, look at data. And usually if you’re bringing in the, in the financial investor and someone from the board to look at the data is usually negative. So yeah. And we usually have to decide, you know, how do we respond to that. What’s the next. So so from a technical level it’s really, really important for where we are in my job. As an investor, the the later and later stage you invest, the more becomes commercial and less about the, you know, the the ins and outs of the technicalities. The business acumen obviously is critical. You know, in the end, your job in investing is to make money. And and so the way investment firms like Brandon work is, our money is coming from your superannuation funds and you want your superannuation to grow, right? It’s it’s not a charity. It’s not something we’re giving back. And that comes with deep responsibility, you know? And I feel that every day; that deep responsibility to make a return and which makes it quite different, from a grant body or some of, or or philanthropic organisations. So those commercial skills are really important. The, the one point I’ll pick up on and, and it’s a bugbear of mine, is this idea that we the people invest off their gut. Professional investors do not do that. Right. And that’s not something that’s part of… any part of your skill set that you have. And a lot of people will will talk about that. And even professional investors, we’ll talk about it. I actually think what they’re doing is a big part of our job is pattern recognition. Okay. And so whilst you might not be able to articulate what it is that you felt in your gut. You know, it may have been subconscious, but I still think you saw something that you’d seen before. And so while you might be, it might be your gut or your nose. I choose to call it pattern recognition because it sounds less waffly, and it feels a bit more like something you can build as a skill. And I truly think for sophisticated venture capital investors, pattern recognition is a big part of the job. You know, it’s about: ‘I’ve seen one of these before. I know what the problem is’. Or, ‘I’ve met a person like this before and this personality. And I know what the what the challenges may be’. You know, what the opportunities may be.

Robert Klupacs [00:09:14] I’ve never heard anyone venture capital actually articulate that, but this sounds and resonates with me. It makes sense.

Dr Chris Smith [00:09:19] Yeah, I hope so. I hope so, and it just demystifies it a bit. But I’m a technical person, so maybe I just can’t cope with the idea of having guts, and maybe it’s just wrong. Yeah.

Robert Klupacs [00:09:31] As I said before, Brandon is one of Australia’s best known and largest venture capital firms. And I’ll ask you in a moment how much funds you got under management to deploy. But I know most of my listeners when you were coming on said great, cause I just want his money.

Dr Chris Smith [00:09:44] Yes. Yeah, yeah.

Robert Klupacs [00:09:45] What would be, and you sort of touched on that before, but what would best describe your approach to identifying and evaluating opportunities for Brandon support? And secondly, what are the key things that you look for given what you said before about pattern recognition?

Dr Chris Smith [00:09:59] So yeah, there’s certainly multiple answers to what we what we look for. One thing about any, any business is that if you have one Achilles heel, that’s unsolvable, then that’s usually, you know, not a business.

Robert Klupacs [00:10:14] Right.

Dr Chris Smith [00:10:15] And so there’s a minimum requirement across our technology. For example, in now in our sort of sector – intellectual property. You know it’s defendable. That can give you a strong position commercially. It’s just a it’s a must have. All right. It’s a minimum requirement. Having a technology that addresses an unmet need that the that is going to satisfy. You know, there’s a lot of people that come to the table when it comes to successful medtech and biotech opportunities, right? If it if it doesn’t help patients. It doesn’t matter. Right? It’s not necessary, but it’s got to work with clinicians. It’s got to fit into the the the actual patient flow and the clinical flow. It has to work with payers like payers are a big part of our system. Now if it’s an Australian product then it better work with, you know, the PBS or the government’s paying schemes. Otherwise it’s not ever going to take off if no one’s willing to pay for it. Hospital is a big part of our system now, too, right? It’s got to work with the hospital system as well. If it’s completely inconvenient, or you’ve got to build a new facility. Then these are big capital expenses. So there’s a lot of components that come into to making a product, and probably one your listeners don’t necessarily straightaway think of is it’s got to fit with our investors as well.

Robert Klupacs [00:11:29] Yeah.

Dr Chris Smith [00:11:30] You know, if it’s going to take 20 years, then maybe that’s too long. Okay. And, if it’s all the risk. Yeah. Because everything we invest in is, by definition, has a risk of, say, if all the risk is not addressed until, you know, right at the very end and there’s nothing you can do to address risk as you go along the path, that can be sometimes unattractive as well. And so there’s so many components that go into, building a good business that makes sense. One thing I would say, especially if you listen to this, is that. While there’s some things that are minimum requirements that every single investor globally will have, not all investors are the same.

Robert Klupacs [00:12:11] Yep.

Dr Chris Smith [00:12:12] And some of us have different mandates and often they’re set by our investors. And so it’s completely normal that you might approach 100 investors before you get one ‘yes’. And people don’t realise like, ‘oh yeah that’s a bit unfair. And why, why didn’t the first one get the message?’ And there’s lots of reasons for that. But even with our companies, when we invest early we didn’t change sides of the table. We’re trying to look for investment in those companies as well. And we have the same outcome. We approach 100 investors and then we might get 1 or 2. Right. It’s exactly the same. So it’s no different for anybody. And that’s just part of the business. You you have to you have to. It’s a lot of hard work. You got to be resilient. Resilient a word we use a lot in our Industry. You’ve got to be super resilient to get through it.

Robert Klupacs [00:13:00] I think you’ve already answered. The next question I had was, what advice would you give to entrepreneurs who want to approach you with a proposal? Because all that people say it’s all about the selling skills, but sounds like to me. So there’s a number of things you look for. Making sure they’re all ticked off.

Dr Chris Smith [00:13:14] Yeah.

Robert Klupacs [00:13:14] Then that’s sort of the qualitative feel as well. But people tell me it’s all about the sell. How much of it is the sell and how much of it is to give you the information you need to make a decision.

Dr Chris Smith [00:13:27] Ah, it’s a great question. And then many people have written books about how to do this and there’s lots of different approaches. One is you you need different approaches for different people. So what works on me doesn’t work on some of my colleagues who are in exactly the same company. Right. We all have different approaches.

Robert Klupacs [00:13:44] You’re the nice one, Chris.

Dr Chris Smith [00:13:45] Yeah. Yeah, exactly. Yeah, yeah, but people learn differently, you know, if you know how you even approach this, if you’re speaking to one of my colleagues who’s got medical training, they always start with the patient in mind. You speak to me. I’m a scientist by training. I love to know how does it actually work? You know, what’s the mechanism? I like that I feel comfortable there, and I. I start with the pitch and I build from that. All right, so you’ve got to be ready to be adaptable. So that’s one thing I’d say to any entrepreneur who’s looking to raise is know who you’re talking to.

Robert Klupacs [00:14:17] Yep.

Dr Chris Smith [00:14:17] Right. And and think about their frame of reference and where they’re starting from. And be ready to adapt it. One story, one sell story doesn’t work right. You’ve got to find you got to be really adaptable. It makes that job really hard. Right. Entrepreneurs are very who are successful are very, very good at that. The other thing I’d say is try not to try and find a reason to know the person you’re talking to. You know, in the end, every investors, no matter whether you’re buying or selling, we’re all people, okay? And very much when you invest in into a new medtech company, you’re probably investing in these people for ten years, sometimes more 15 years okay. A really important thing when you invest with someone for 10 or 15 years, you want to get along with them, right? You want to have a good relationship with them. You want to know you can trust them. There’s so many soft qualities which are just critical for making that happen. And it starts from there on, on on day one. Right. So, you know, everybody listening to this knows knows you Robert. And you can go, well I can make an introduction to Chris. Right. Do that. Don’t cold email me and try and work out my email addresses, because it’s just not going to work. In all of my time in investing 12 years, I cannot think of a single time we’ve invested in a company where someone has cold emailed. Its not once.

Robert Klupacs [00:15:37] Well.

Dr Chris Smith [00:15:38] Not once. It is always come from word of mouth through a connection or something along those lines that they bring you in. It’s really important that people relationship. I hate people that just sell, right. Have a chat with someone you know. It’s you don’t need to come in and sell something on the first day. Come in and be inquisitive. Who are you? What do you do? What are you looking for? You know, actually, like you would with anyone else. In the same way, if you think of it about as like meeting your partner, your potential, you know, partner for a long time, you don’t come in on day one and say, you know, where’s the keys to the house and how are we going to have we’re going to manage this relationship. And will you sign the dotted line now? That’s not how it works, right? You come in, you I get to know you and make sure you’re the right fit. Maybe if we think of it a bit more like that.

Robert Klupacs [00:16:27] It’s a journey.

Dr Chris Smith [00:16:28] It really is. It really is. And I don’t want that to feel like it’s, you know, you don’t have to treat people any. You know, treat people carefully or worry about, you know, especially investors. But I do think we can manage it better. And just even just going for a coffee is a great way to start.

Robert Klupacs [00:16:43] Yeah. Fantastic advice, which I’d had many years ago. We’ll talk a bit about the role of venture capital in R&D. We looked at some stats and we’re not sure this is correct, but the rule of thumb that we’ve been we’ve read about is if most venture capitalists work on a ratio of five failures, three break even, and two successes out of every ten, I suspect it’s actually less successes out of ten. But is this true? And maybe you can’t tell us, but generically, what is the Brandon hit rate? Is it better than average? Are the stats true or you’re worse than average because you do get very early. So compared to most big international venture funds you are much earlier than them.

Dr Chris Smith [00:17:23] Yeah, exactly. Exactly. Yeah. If you read the venture 101 handbook, that’s what it says. A really fascinating you, your listeners who who might not understand portfolio theory and those sorts of things. A really fascinating thing is that actually having failures is, is a really important part of your business, because what it tells you in your, in this your investing mythologies, you’re investing in high risk, high return opportunities, which is a really important part of the business. And that’s how venture works. Venture works by investing in businesses which generally don’t earn any money, they usually working into a very new area by definition of usually first in class products and and your expectation if you’re really pushing the envelope of what’s possible. As all of your listeners know who have med tech background and biotech background, you can’t predict what’s going to happen.

Robert Klupacs [00:18:17] We all think we can.

Dr Chris Smith [00:18:18] Yeah, we all think we can, right. And me included, but the reality is we just we just can’t. Some of the best ideas you’ve ever seen get into late stage clinical trials and just don’t work out right.

Robert Klupacs [00:18:29] I invested in them.

Dr Chris Smith [00:18:31] Yeah. Yeah. Exactly. And so that’s part of the business. But it’s a really important part of what we do. And we we as an industry pride ourselves on the fact that that’s what we’re doing. Because if you keep doing conservative, just very incremental advancements, you don’t actually push human health. And we wouldn’t have had the breakthroughs we’ve had, you know, in the past 30, 40 years in our industry, if you think about what biotech’s done in the last, you know, 40 or 50 years, it’s been phenomenal impact. But the success rate is not perfect. Like it’s not a case of a 100% success rate. That’s not how industry works.

Robert Klupacs [00:19:05] You know that going in, but you still try to make sure you’re efficient. You want more wins than failings if you could. So what are the… don’t want to say tricks, but what do you do in your portfolio to say to try to ameliorate risk that you can? Is there something specifically that you do or is it always milestone funding or is it something else?

Dr Chris Smith [00:19:26] Yeah, absolutely. Absolutely. So the way it works and the way you want to work is you want to ask the really difficult questions early. And it’s something that professional investors will always do. So if there’s an experiment we can do early that addresses risk, then we’ll do it. And we certainly won’t avoid it. Right. So you want to find out that answer early before you’ve invested a lot of money. Because if it did, if you get to, you know, ten years in and a lot of money and then you ask a question or you do an experiment, or you test the market and it’s something you could have done nine years earlier and it fails. Then that’s a problem. You know, that means you’ve lost a lot more money than you can know. The way the model works is that you want to try and get as much money, you know, as much as your money into the ones that succeed and the ones that eventually going to fail, then then you want to have invested as little as you possibly can in this.

Robert Klupacs [00:20:19] Because we have a similar policy here at the institute, because we have lots of projects.

Dr Chris Smith [00:20:23] Yeah.

Robert Klupacs [00:20:24] And most academics don’t like it. But what we’ve introduced is, is fail fast. If you’re going to fail, fail as quickly as you can because the opportunity cost is massive.

Dr Chris Smith [00:20:31] Yeah.

Robert Klupacs [00:20:32] And there’s so many things that we want to do we can’t do them all. So it’s great to hear you say that from a professional investor point of view, because that’s what we do here. But it’s not necessarily the academic mindset. So you’re dealing with very early discovery lots of the times, with many cases, academic scientists who aren’t trained like you are, even though you’re an academic scientist who thinks, oh, this is fantastic, just let me keep playing, when in fact you’ve got to make a call quickly. You can say, we can do this. We’re off. We can do next. We can’t do this. Don’t come back. Yeah. How do you go with that discussion with, you know, the type of people that we grow up with that don’t like hearing that.

Dr Chris Smith [00:21:08] No, no. And that’s true. And it’s it’s actually a really important cultural change we’ve got to have. And something I’ve really seen change in Australia over the last. You know, 12 years I’ve been in venture investing. Embrace it. You know, it’s the best thing you can do because it’s such an important part of our business. And I, I must say, some of our colleagues across the Pacific are better at embracing that, of just saying, hey, I did a Start-Up and it didn’t work. Yeah. And some people, I think historically have seen that as a negative. But on the investment side, we don’t. We see it as a real positive. Right? We see it as a positive because, one: you’ve gone through the process, two: you’ve learnt, right. And people may not realise is that when you’ve gone on this journey, a first time entrepreneur, you know the probability of success is not very high. All right. But a second time entrepreneur, irrespective of what happened in the first one, the probability of success almost doubles on their second time. And so starting to really have the conversations to reframe. And maybe we need to go away from the word fail because it comes with such connotations of, personal, you know, that I failed and it’s not it’s just you had a hypothesis and it didn’t work out. Yeah, right. And that. That’s okay. Right. And that’s really important. And trying to help people out with that. And I now I’ve got more experience. I actively have the conversation upfront now and try and just say, hey, this is one of the options that might happen here. And it’s okay. Right. And this it’s actually a really good opportunity for you to do your next one. And and it’s part of what we do.

Robert Klupacs [00:22:53] That’s fantastic to hear. This is a med tech primary audience. But we discussed this before we came on. Med tech is such a broad term. You know, digital health. Yeah. diagnostics all the way through to algorithms/AI. But really when we talk may take on this call. We’re primarily talking medical devices. Yeah. And whether it’s fair or unfair, there is a perception that Australian venture capital, when it comes to biotech/medtech prefers drugs and diagnostics and doesn’t really like medical devices. And some of the stats I’ve seen would show it’s probably 80 or 90 biotech and 10% devices. Is is that true? Is there a reason why that might be true, or is it, the stats not really the case that you’re not just seeing… you’re seeing the same number of opportunities. But as you said before, maybe not investible.

Dr Chris Smith [00:23:42] Yeah, exactly. There’s certainly on a numbers basis, and just sheer number of, you know, Start-Ups that are around biotechs and med techs, the numbers are, twisted towards biotech, actually interesting on a weight of capital perspective. It’s probably not the case.

Robert Klupacs [00:24:00] Okay.

Dr Chris Smith [00:24:01] Which is interesting and it may be debug is one of the notions that and we we invest in medtech as well. And you know, I have I’m on the board of Q-Sera, which is a med tech company, and we’ve got a whole bunch of, you know, digital health and medical technology companies that, that are in our portfolio. So we’re one of the ones that do do that. But an interesting thing is that we often think of med tech as being much faster and cheaper. Right. And, and that is a really important lesson that we do in our community. We know. Right. And that is that in general, medical devices take longer and cost more. And it’s not the case that they, they take longer and cost more to get to registration. They much, much quicker as we know. Right. The FDA process for a drug, you know, typically takes at least ten years, you know, and sometimes more to get this. So medical devices are faster from that perspective. But from an investor perspective, an investor looks at it from the time that they put their money into the time they get their money out. And, and so what we’re actually comparing is usually in, in drug development and biotech, it might be from the time that you go pre-clinical to phase two. And then the pharmaceutical company buys you in med tech ,might be from, you know, product concept, you know, all the way through to launch commercial launch, and then sales. And so with that in mind, one thing that you know, I’ve certainly noticed in my career is that the skill set that I need to be able to make a medical device and get through the regulatory process and understand the clinical aspect is very different from building, buying a sales force and distributing it and doing those sorts of things. And so from that reason, even for me personally, on an investment side, it makes it so much harder because I don’t know anything about how to build a sales force and and how to run a business like that. And so I do think there’s a mixture there of reasons for why we’re seeing that, you know, across the industry. And it’s not just a, pattern we’re seeing in Australia. It’s not it’s a global pattern.

Robert Klupacs [00:26:05] Yeah, that makes sense. I mean, the other thing you said there was quite, quite interesting. So biotech we’ve all done it. Concept phase two: buy out partnership.

Dr Chris Smith [00:26:12] Yeah.

Robert Klupacs [00:26:13] But the whole ecosystem in biotech is it’s like a big ocean of fish eating bigger fish all the way up to sharks. Yes, but med tech big may take this early stage and it’s not very much in the middle. And that’s what is it? Would that be part of your investment thesis, that it’s hard to get access to medical devices?

Dr Chris Smith [00:26:31] Yeah for sure. For sure. The consolidation of the large medical device companies over the last ten years is notable, right? You can’t not have seen that. And one thing that happens with consolidation is that those companies start to go later and later stage. Yeah. Which requires us as entrepreneurs and and investors just to, to be with companies for a much, much longer period of time in order to get the, to the end.

Robert Klupacs [00:26:55] Yeah. I’ve got a few more questions. I could talk to you all day. Yes, yes is fantastic, but I know we’ll kind of take it all your time. You’ve got a very long history now. PhD; you’ve been in the UK. Come back; now in venture capital. How do you think Australia really does compete on an innovation scale from what you’ve seen? And how can we do it better? Because we’ve got some pre-existing thoughts. We all know Australia is great at the research phase, generally being relatively poor from a translation perspective.

Dr Chris Smith [00:27:27] Yeah.

Robert Klupacs [00:27:27] That’s our thesis anyway. But from where you sit. How do you think Australia’s performing and what could we do better to actually get the fruits of what’s clearly a wonderful research capability?

Dr Chris Smith [00:27:38] Yeah. I agree, we have a a phenomenal research base. I do sometimes think we get unfairly, we unfairly compare ourselves to Boston. Right? And, it’s interesting because I travel around, the US quite a bit. And if you’re outside of Boston or San Francisco and maybe San Diego, everybody else in America talks about how they’ve got great research. But no, you know, they they struggle to commercialise in these sorts of things. So apart from a very few small hubs around the planet, and you might want to put, you know, Cambridge and Oxford and London in there as well. We’re not… it’s not as bad as everyone thinks, right? We’re actually a lot more on a level playing field than than most people think. So I don’t want us to be too down on ourselves. It’s not even in the time that I think directly in venture, it’s improved enormous amount. The amount of money that we’ve got to invest. But the expertise and the people and the people coming back from overseas with training has, is increased exponentially. And we we hope that it’s going to keep doing that. And we at Brandon have a philosophy of trying to do everything we can to keep building that ecosystem. And so that we can we can not feel like that. I think. You know, there’s lots of reasons to have hope, and there’s lots of reasons to think that we’ve got the capabilities and it’s coming. And I’m seeing that because I’m at the forefront of it all the time. I do think we, you know, I… as a country where is biggest California, right. We can do… we can have a San Francisco. I do think we could become more coordinated in how we do it. You know, we do have a, a geographic challenge in the sense of our… You know, we’re a long way obviously from the biggest markets to some degree. But we’re also we’re a long way from each other. You know, our cities are quite a quite a way apart. We do need to just. The competition is not local.

Robert Klupacs [00:29:38] Yep.

Dr Chris Smith [00:29:38] You know, there is no competition in med tech between Sydney, Melbourne. You know Perth. That’s not the competition. The competition here it’s a global competition that we play in. And I think working together more as a nation I think would be an amazing, simple way of leveraging the skills that we’ve got at the moment. We have phenomenal ability to do clinical trials early. Right. To testing our products, to prototyping, access to patients. We have really talented people. We have a a culture that embraces collaboration. Right. We got so many advantages for how we can do really well in med tech. And we as we starting to see the fruits of that, and I think even more so now that we’re in an era of cross collaboration. Like it’s not often now that you don’t have a new med device that somehow involves AI, right? Or machine learning or some digital aspect, right, that goes along with some hardware. And, you know, nobody has all of those skills anymore. The days are gone where where an individual comes up with an idea like that’s not and so Australia’s perfectly set to grab hold of that. And we are and, you know, in the past we would have said, oh, well, there’s not enough capital around. That’s not the case anymore. There is capital around. For good ideas. They will get supported and they will grow. Absolutely. And there’s people around that have seen the journey before now. You know, they’ve made medical devices. They’ve got them to market. They’re in here, they’re here, they’re in Australia, they’re in Melbourne. We can access those people now. So we’re slowly slow and it’s taking time, but we’re slowly removing some of the key barriers that have stopped us really. You know, leveraging those those raw skills.

Robert Klupacs [00:31:26] Well, that’s good to hear. You know, someone from their large venture capital firm being is positive about that because they’re quite a few people come through, aren’t quite positive. And like, they give me lots of feedback, shall we say. Let’s just say it’s all about maturity and growing and being being honest. I want to come to the end because we’re running out of a bit of time. There’s a lot of a lot of questions we do want to ask you just to finish off this, a key focus when we set this up was learning a bit the power of mentorship, both giving and receiving, particularly when it comes to innovation and commercialisation. Picking up the point you just spoke about. So we’ve got a few questions for you to finish off.

Dr Chris Smith [00:32:00] Yeah.

Robert Klupacs [00:32:00] So what do you think makes a good mentor, particularly for first and second time entrepreneurs?

Dr Chris Smith [00:32:09] My immediate thought that came to mind there is one that doesn’t tell you what to do.

Robert Klupacs [00:32:13] Right, ok.

Dr Chris Smith [00:32:16] Entrepreneur-ism is by definition an individual pursuit to some degree, right? You really have to go in the face of what’s out there already, and you’re usually you’re pushing the boundaries. And so having someone tell you what to do is usually not a great solution. Having someone that can give you learnings and watch-outs is really important, for me. You know, some of the best mentors I’ve had, I’ve just been networked so well. Right. ‘Hey, this is what I’ve done. This is what happened when I had a similar situation. But he’s three other people that have done something similar’. Like that’s the value of the network and and plugging in with lots of people. Because one thing we want to do when you’re an entrepreneur is not make the same mistakes that everyone else has done, right. It’s fine to push the boundaries, go and do and learn new mistakes. That’s that’s what you’re in. But you don’t wanna make the same mistakes that other people already knew. And so that looking for a mentor that can do that. I think it’s really, really, really important.

Robert Klupacs [00:33:16] So when someone, when you’ve identified a first time, inventor/entrepreneur at Brandon, and you’re backing them, how do you mentor them? Because for them, it’s, you know, that they’ve had a history of brilliant people by definition. Now they’re doing something completely different. Yeah. What support do you give them or mentor I mean, no, I know people that work with you and I speak it’s and it’s really hard to get you, but once you’ve got you they’ve got a partner for life. Something you mentioned before that. Yeah. What’s your process and how do you go about it?

Dr Chris Smith [00:33:43] Yeah. Well one thing we really try and do is we actually essentially run an incubator, and now there’s no labs or, anything within our incubator, but it brings the entrepreneurs together and also very close with us. And so, often, you know, entrepreneurs in the early days, we’ll be very hands on, really trying to help them out. And so that you can leverage the skill of the Brandon team, but also the other Brandon investment companies all in one place, because being an entrepreneur can be very lonely, right? And you don’t want that, right? So pulling together those people in the one location and we do do that is, I think probably one of the best things we have ever done as a firm, especially in Australia, where, as you said, if it we just we we starting to do, you know, entrepreneurship. We really started to do that with respect to life sciences and building companies. But there’s not the depth of people that have, ‘hey, this is my fourth company. My fifth company’. Yeah, but you want to be around those people. And when we’ve got them and we do have a few, then those people have, we believe, have a responsibility to the rest of the ecosystem. And so, to, to really help and to really help out, all the time.

Robert Klupacs [00:34:55] Back to you, who’ve been your mentors, Chris?

Dr Chris Smith [00:34:58] I’ve certainly had lots of mentors over the time. Interesting. You asked me that today. One of my mentors is, is from the UK and just happens to be in our office this week. So wonderful. It’s been lovely to, to see him again. Just people that have you generally people that have seen the movie before, is how I describe it. I really get I personally really get comfort out of those people. That can just say, ‘I’ve seen this before. It’s going to be okay. And here’s some directions on how I’d respond’. And so, yeah, it’s been lovely to have I have been back in town and, and to reflect on that. But we always need a mentor. Right. There’s, there’s always people that you in and it can change over time as well.

Robert Klupacs [00:35:44] The other thing we sort of we talk about, this is the last question for you, but people often ask me, and I imagine they ask you, how did you finish up with what you did? So if you take yourself back, you know, you left you you’re going to be a champion horse rider. Yeah. But then you decided to go back and do a science degree. Let’s the guy that went back to do the science degree. Looking back, I think that’s about 30 years ago. Yeah, maybe maybe twenty.

Dr Chris Smith [00:36:06] Six. Yeah.

Robert Klupacs [00:36:08] Yeah, six. Well that person, looking back, and if you could talk to that person today, what would you say?

Dr Chris Smith [00:36:14] Well, the first thing you say, ‘don’t worry, it’s going to be okay’ is the very first thing you’d say. Yeah, I certainly wouldn’t give them any advice for the same reason I just said, you know, I, I’m very wary of people that, you know, give advice and tell you how to do things and don’t let you learn for yourself. But I think the most important thing I’d say is ‘it’s going to be okay’, because when you go on a journey where you’re not, it’s not necessarily driven by clear goal. You know, so many people in our industry started off as scientists or medics with this quite defined career, right? It’s very brave that person that steps off that tram and says, you know what, I’m going to do something a little bit different. But with that, and just because you’re brave enough to do it doesn’t mean you don’t feel it, right. You don’t feel that uncertainty. And so, you know, I think that the most important thing I’d say is it’s going to be all right.

Robert Klupacs [00:37:04] Oh, great. Chris, we’ve reached the end of the podcast today. Thank you so much for sharing your insights and just this chat, it’s been wonderful. And particularly and it really some of the insights into innovation in this country has been wonderful. To our listeners: I hope you enjoyed listening and I look forward to introducing you to our guests in future podcasts. There are links to everything we’ve talked about in the show notes, and we look forward to welcoming you next time.

Listen to other episodes of Med Tech Talks here